Building wealth is not an easy thing to do these days. However, one way to really catapult your wealth into another level is by owning a lake home. The difference between how much you owe on your home and your home’s value, also known as equity, is a very important piece of your personal wealth. by Matthew Scott, MBA Mortgage on October 29, 2018.

Lake homes are generally, speaking, an appreciating asset, therefore you build wealth over time. This equity is not always liquid, but it can certainly act as an asset for emergencies, future financial planning whether it be for college tuition, starting a business or simply providing for retirement. Bottom line…building equity is one of the first steps to accruing wealth.

Why is building equity on a lake home different? For starters, many lake homes are secondary homes or homes passed down from one generation to the  next. What are some key factors that matter when looking at your equity in your lake home? Let’s look!

next. What are some key factors that matter when looking at your equity in your lake home? Let’s look!

Initial Investment in equity:

Simply put your first investment into a lake home is your starting equity, so when buying a property, the larger your down payment, the more equity you’re starting out with. Generally Speaking…The more your put down, the better the mortgage terms will be. Notice, I did not say, the better the rates! Rates are not entirely dependent on down payment, but your payment is! A larger down payment may result in better terms and a lower monthly payment. Of course, rates, will certainly be a major part of that equation.

When you can come up with 20% down, you open a lot more doors to create wealth quicker because you avoid Private Mortgage Insurance (PMI), but it’s certainly not a requirement. According to Zillow’s 2017 Consumer Housing Trends Report, only a quarter of buyers pay 20 percent of their home’s price upfront.

Most lenders will accept as low as 3% depending on credit score and some other factors. Many will argue that it’s better to put down more because of this PMI, which is a risk-based insurance you pay to cover any future losses should you default on the loan.

But why is lakefront different? Well…again, many of these homes are secondary residences, and when it comes to secondary homes, there are a few more factors that go into down payments and building equity.

Qualifying for a mortgage on a secondary lake home can be much harder because you must show the ability to carry both your primary home’s mortgage (if you have one) and the new mortgage. From an underwriting standpoint, second homes are more risky than primary residences. There has always been and will always be that when times get tough and decisions need to be made on whether to walk away from a home, more homeowners are more likely to default on their vacation homes than their primary residences.

When that level of risk is there, it certainly creates more scrutiny in the underwriting process to ensure that loan is as low risk as possible. Buyers should expect to provide at least a 10% for their down assuming good credit, and the lower the scores, higher that requirement goes.

Many times, as soon recently in 2018, 39% of vacation home buyers paid cash as reported by the NAR (National Association of Realtors). For many people, it’s just easier and less frustrating to pay cash, and many homeowners look at this cash investment as another vehicle to build their wealth through real estate leverage. However, equity in a lake home isn’t as liquid as on primary residences. Since vacation homes are luxury properties and not necessities, they may take longer to sell and doing a cash out refinance to get that equity out results in the same underwriting process as above. The good news is that many lenders will allow you to pay cash and recuperate your cash within a few months if you would like through a delayed financing refinance program. This is a great way to be competitive with the offer, which not liquidating all your savings.

In general, when it comes to equity and in the event of a financial emergency, it won’t be as easy to tap into your lake home’s equity for help.

Payment acceleration:

Unless you are looking to flip homes, most real estate investments are long term goal oriented. Lake home inventory is not as high as the demand for it. So, how can we accelerate the wealth building process?

Quite simply, the faster you pay off the principal balance, the faster you build equity. That’s assuming, of course, your home value stays the same or increases, but not everyone has extra money to through at the mortgage each month.

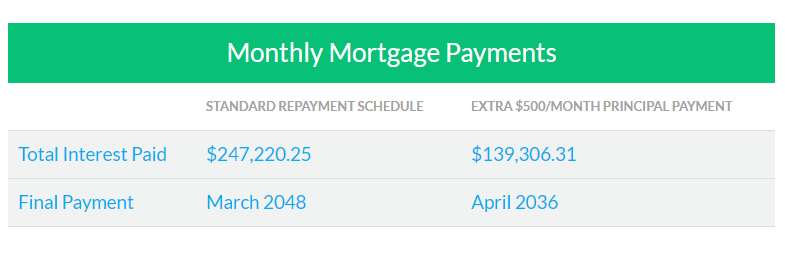

However, what if you had rental income? Not all lake homes are rented, but many homeowners will rent specific weeks out throughout the year to generate some additional income from the property. What to do with that money? Well… we could pay the real estate taxes or the homeowners insurance each year with it, but more times than not that money is rolled into the mortgage payment through escrow anyways. What about throwing it towards the mortgage payment? Any money over and above the minimum payment will go directly towards the principal balance. For instance, if you take a $300,000 mortgage at 4.5% (30 year fixed) and you can pay an extra $500/ month towards the mortgage, you can essentially pay that home off 12 years faster, as well as reduce your total interest paid by about $108,000! The following is an example from LendingTree.com.

Courtesy of LendingTree.com

So, lets leverage that rental income into additional wealth for you! It would take 216 months of saving that $500/ month to equal that $108,000 interest savings. According to HomeAway, In 2014, vacation rental owners charged an average rental rate of $1,520 per week ($217/night). That translates to an average residual annual income of $27,360 for the owners.

Using rental income to pay off your lake home’s principal balance is a smart financial move that requires minimal effort, aside from some miscellaneous costs

Fix it up!

As mentioned above, many lakefront homes are passed down from one generation to the next. Changing that “quaint/ family feel” to it, can be something that many homeowners do not want to do. However, making some improvements around the house not only makes it easier to sell later, but…. Wait for it…. builds equity and wealth!

You must have good vision and understand what will add value and what is simply costing money. While its certainly important to do some things that NEED to be done and some that you WANT to be done, it’s important to understand renovation rates of return. Some updates can help you, others simply cost more than they’re worth. Therefore, it’s important to consult a real estate professional and a contractor before investing in home improvements.

You may not know that some common updates show a negative return on investment such as master suite, bathroom and deck additions. While these projects may be glamorous and popular, they often cost twice as much as their resale values. A great article about this can be found here at realtor.com.

In many cases… “less is more”. In fact, simple tweaks like attic insulation, garage door replacement and minor kitchen remodeling offer the best returns on investment.

Landscaping, bathroom improvements and fresh coats of paint can help increase the value of your lake home, too. Curious about energy efficiency… well… that’s a whole other article.

As you can see, there is great reward and great potential when owning a lake home. However, there are also some potential other hurdles. If you are truly looking to build wealth through real estate and secure a spot that you simply love to go to, you should highly consider looking at a home on a lake. Who knows…. Maybe even pass the home down to your grand-kids.

Want to know how much lake home you can afford? Contact MBA Mortgage here.

Re-posted by Scott Freerksen “The Lake Guy”